The banking landscape has been evolving very significantly in response to the advancing forces of customer expectations, technology adoption, regulatory environment, etc. Banks have always been quick in adapting to the ever-changing banking ecosystem in India. Still, when it came to customer onboarding, regulatory guidelines allowed for limited innovation in this space. Additionally, complex onboarding processes act as a massive barrier for a large percentage of the population leveraging banking services.

What are the challenges for the banking industry?

It’s vital to note that many users might not be comfortable with a digital approach. Doing anything for the first time always presents a concern of the unknown. Add to that; online fraud is a real concern. Unfortunately, the significant increase in new online activity comes with certain inherent risks. Security is fundamental, both to new users and organizations’ profitability.

More than 77 % of users claim that the account opening process can “make or break” their relationship with a financial services brand. Ensuring a simplified and streamlined process can help banks manifold their customer base.

The sweet spot, considering both a good onboarding experience with security and compliance, will provide you a holistic solution. A practical approach considers user journeys and back-end workflows, various risk profiles, and jurisdictional reviews to deliver a good customer onboarding journey.

How RBI became the enabler for the digital onboarding process?

To make life easy for all stakeholders including, Banks, Legislative norms, and customers, RBI has introduced the Amendment to Master Direction (MD) on KYC circular, dated 09th January 2020, allowing you to handle onboarding digitally. These guidelines enable users to get on board with whichever banking services they like the most rather than opting for the bank near them.

RBI has amended the KYC norms with a voluntary Video-Based Customer Identification Process or V-CIP as a substitute for physical onboarding. The most significant benefit of this change would be witnessed in the villages where banking infrastructure finds a hard time to penetrate. Customers can choose to use OTP based Aadhaar verification or display their OVDs for verification on a video call with the Regulated Entities. RBI has also mandated geotagging of the customer to ensure that they are present in India at the time of onboarding. Once the application filling and verification are completed, the video proof would be available for concurrent audit, which would give a final clearance.

What are the Benefits of Introducing Digital Onboarding in the Indian Financial System?

- Instantaneous response by automating multiple tasks like data entry, verification, and credit checks using RPA.

- Reduced drop-offs by 35%

- Significant reduction in customer dissatisfaction

- Unified governance speeding up process management

- Better Customer Experience

- Faster access to banking services

- Lesser paper usage

- Better operational effectiveness

A McKinsey’s survey suggests that approximately 55 to 80 percent of customers in Asia would consider opening an account with a branchless digital-only bank.

How is Winjit innovating the digital onboarding journey?

Winjit handles complex workflows during customer onboarding in a completely seamless, secure, interactive, and remote environment. In addition to complying with RBI regulations, we have introduced smart OCR to reduce data entry; AI, to do level 1 fraud detection for better onboarding experience.

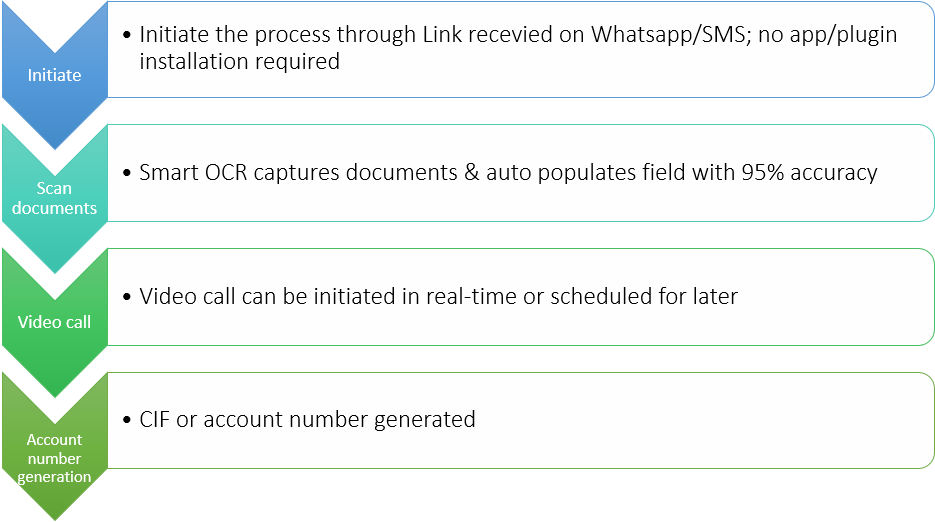

To achieve this, Verification Online by Winjit (VOW) breaks up the process into 4 simple steps:

What benefits Winjit offers for the digital onboarding process?

- Reduce cost to onboard new customers by over 65%.

- Third-party integrations for seamless customer experience

- Verification can be done anywhere

- Reduction in the TAT from 3 days to 10 minutes

- Flexible Payment models:

- Pay per use model for less customer base

- Monthly payment model for huge customer base

Conclusion

With the new RBI guidelines in place, the onboarding process is now exceptionally streamlined, which provides customers a wide range of opportunities and better user experience. Winjit is your trusted partner who can help you grow your target customer base by implementing these features and ensuring higher customer engagement with Video KYC.

About Winjit

Since 2004 Winjit has been helping clients in the financial services sector globally with major emerging technologies such as RPA, AI, ML, Blockchain, bespoke development, and resource augmentation. Get in touch with our experts to know more at marketing@winjit.com.